Action History

The Action History feature in LendingWise is a comprehensive tool that records all actions taken on a loan file, facilitating transparency, accountability, and efficient collaboration among team members.

The Action History feature is a vital tool in LendingWise that provides a comprehensive and detailed record of all actions taken on a loan file. This feature is essential for efficient loan management, seamless processing, and transparent collaboration between team members.

Action History is organized into several tabs, each offering in-depth information on various aspects of a loan file:

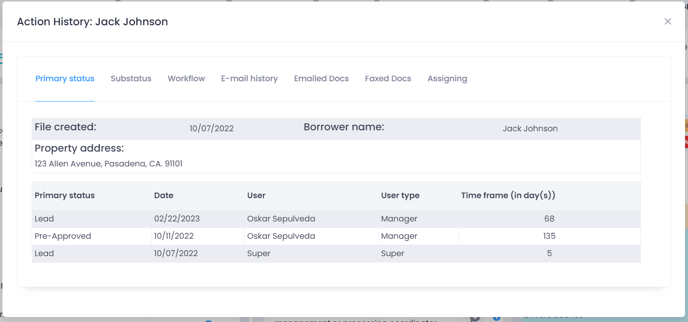

- Primary Status tab: This tab displays file creation details, borrower name, property address, and a history of primary file status changes. It includes the date, user responsible for the change, user type, and time frame in days for each status change.

- Substatus tab: This tab shows all checked sub-statuses, the dates they were checked or unchecked, the user responsible for the change, user type, and time frame in days.

- Workflow tab: This tab lists workflow steps that have been checked, along with the user responsible for the change, user type, and the date the change was made.

- E-Mail History tab: This tab provides an overview of any email history related to the loan file.

- Emailed Docs tab: This tab displays the names of documents from the loan file that were emailed, along with the date, sender, sender's user type, and recipient.

- Faxed Docs tab: This tab shows the names of documents from the loan file that were faxed, along with the date, sender, sender's user type, and recipient.

- Assigning tab: This tab presents a history of employees assigned to the loan file, including the date they were assigned.

Incorporating Action History into your loan management process is crucial for several reasons:

- Ensures transparency and accountability among team members

- Facilitates efficient collaboration and communication

- Improves customer service by providing quick access to loan file details Assists in maintaining regulatory compliance and simplifying auditing processes

- Enhances problem-solving capabilities by offering a clear record of actions taken

By leveraging the Action History feature in LendingWise, users can streamline their loan processing, improve team collaboration, and ultimately provide a superior experience for borrowers.