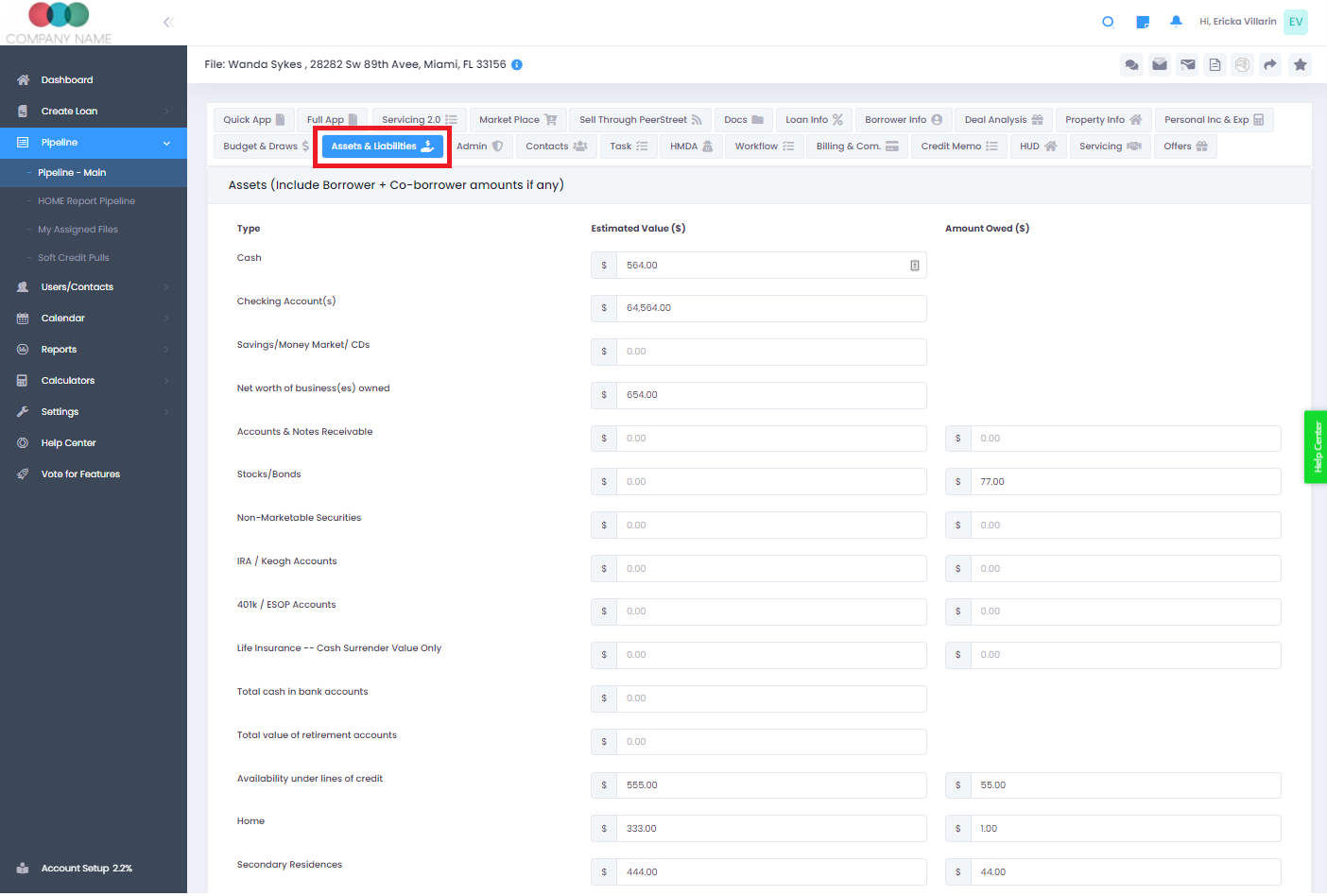

Assets and Liabilities Tab

This article provides an overview of the 'Assets & Liabilities' tab in LendingWise, explaining its functionality for collating assets, real estate schedule, financial account info, and creditor details.

The 'Assets & Liabilities' tab, a key component of the LendingWise platform, offers a comprehensive space to organize and maintain all asset-related data, real estate schedules, specific financial account details, and creditor or liability information.

Understanding the 'Assets & Liabilities' Tab

This tab serves as a one-stop location for maintaining all relevant financial data for any client. It offers several features for detailed data organization:

-

Assets: This section is designed to store all asset-related information, providing a categorized repository and quick retrieval when necessary.

-

Schedule of Real Estate Owned and Sold: Real estate schedules can be complex and exhaustive. This tab simplifies this aspect by providing a well-structured platform to maintain all real estate schedules efficiently.

-

Financial Accounts: From bank account details to investment portfolios, this tab allows you to keep a tab on all financial account information associated with a client.

-

Creditor/Liability Details: The management of creditor and liability details is critical in private lending. This tab provides a neat categorization option that simplifies the handling of these details.

The 'Assets & Liabilities' tab provides a complete financial picture of your clients, thereby offering an understanding of their fiscal health at a glance. This, in turn, assists in making informed lending decisions.

For additional support or inquiries, please contact the LendingWise support team at helpdesk@lendingwise.com.