Creating a loan with Borrowers/Co-Borrowers

Create a loan. Every loan file must have a borrower, which also has an entity with members. Borrowers will have their own profiles separate from their loan files.

Every loan file must have a borrower & optionally a co-borrower. Borrowers will have their own profiles separate from their loan files (See your Borrower list), which contain detailed contact info, experience, assets, entity(s), HMDA, etc... Every new loan created with the email address, will pre-load the borrower profile data into the loan application.

NOTE: A borrower can have many entities inside their profile & the entity can have many members. The Co-borrower will not get created as a borrower in the borrower list.

The Quick or Full App supports a borrower & co-borrower in completing the loan app data. Additionally, you can capture more data on the people associated as a member of the entity. If you want each member or additional borrowers to complete a separate loan application, you will have to follow these work around tips:

FYI... The borrower section & field labels within a loan file can be relabeled to Applicant or Sponsor, if you desire via the Form fields controller.

Borrowers can log in via the borrowers, & co-borrowers can login via the portal, which can be embedded on your website (if you install the private label login using HTML Iframe codes).

Once a borrower logs in, they can see all their loans.

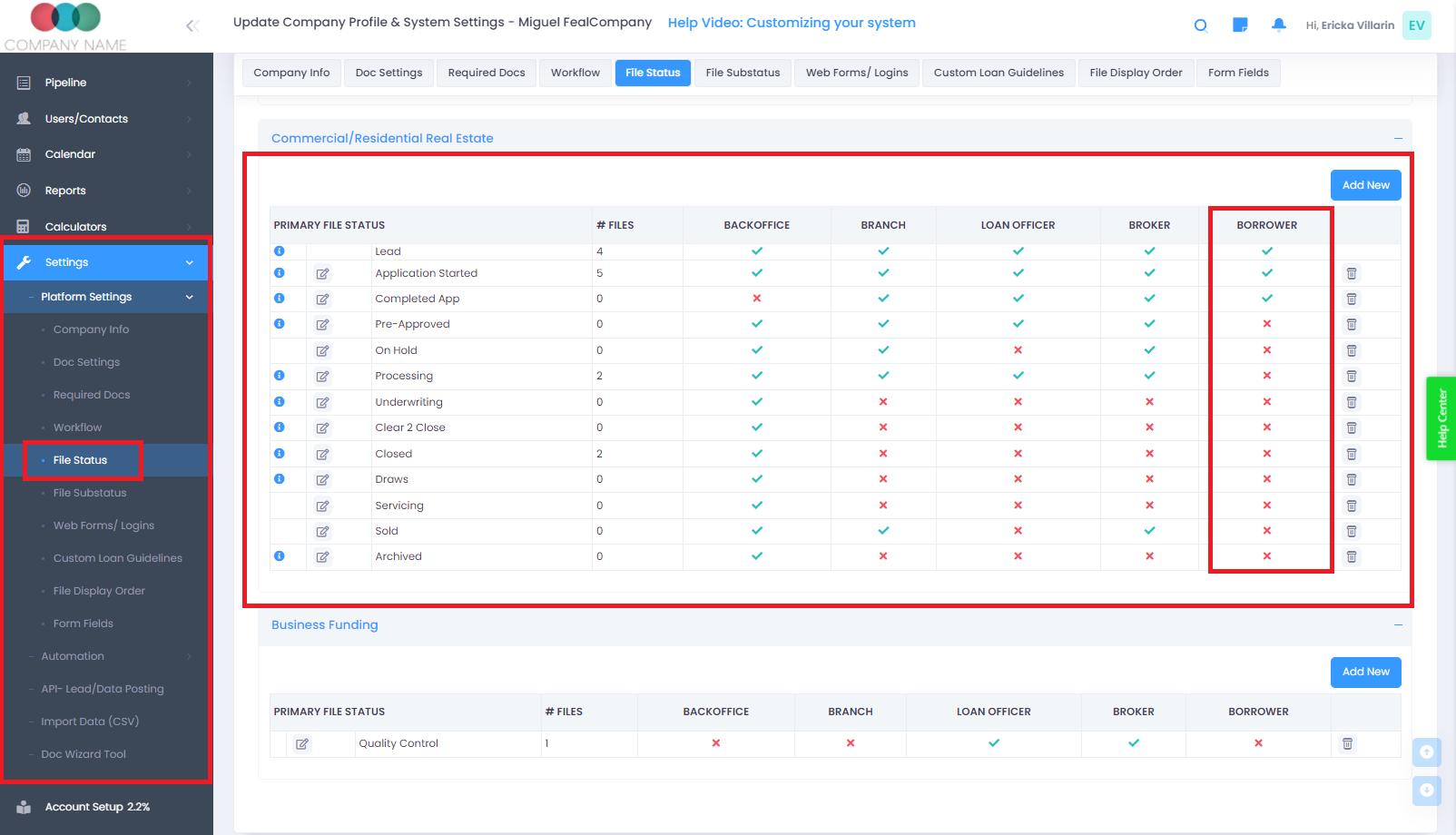

Loans can be:- Editable or View-only- Based on the File Status settings configured in the Platform Settings--> File Status... For example, if the loan status= Loan Application, the loan app will be editable, but if it in processing, it will be locked.

These view permissions are based on the permission set respective to the primary status in your company profile settings--> Primary File Status. See the image below.

NOTE: Borrowers will always be able to make notes, upload docs, and request draws

TIP: Create a fake loan using your own email as the borrower's email. That way you can practice and send yourself borrower-related emails, simulating the borrower experience.

If a client/borrower CANNNOT see the loan in the pipeline, it is most likely client/borrower does not have the control do so.

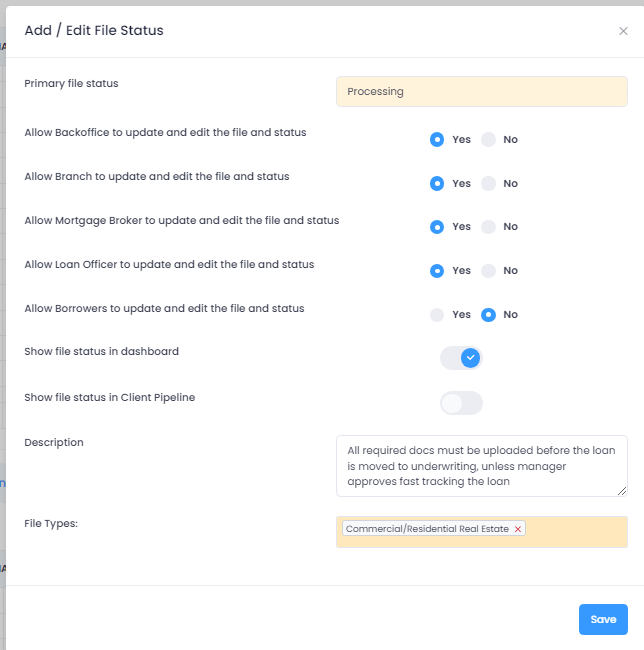

This can be changed in the settings -> File Status, when you click on the edit button. You will see different available options.

In this case below, you can see the "Show file status in Client Pipeline" , which now the client/borrower will be able to.

For additional borrowers (i.e. 3rd, 4th or more borrowers), please create an additional file in the system per every 2 additional borrowers.

To save time re-keying property details, loan terms, and other deal specific information you can click the "copy file" icon located in the green shortcut folder(see screenshot below) to duplicate the file. You click on the newly copied file to edit the additional borrower(s) application details.

Note: you have the option to copy the file "With" or "Without Docs".