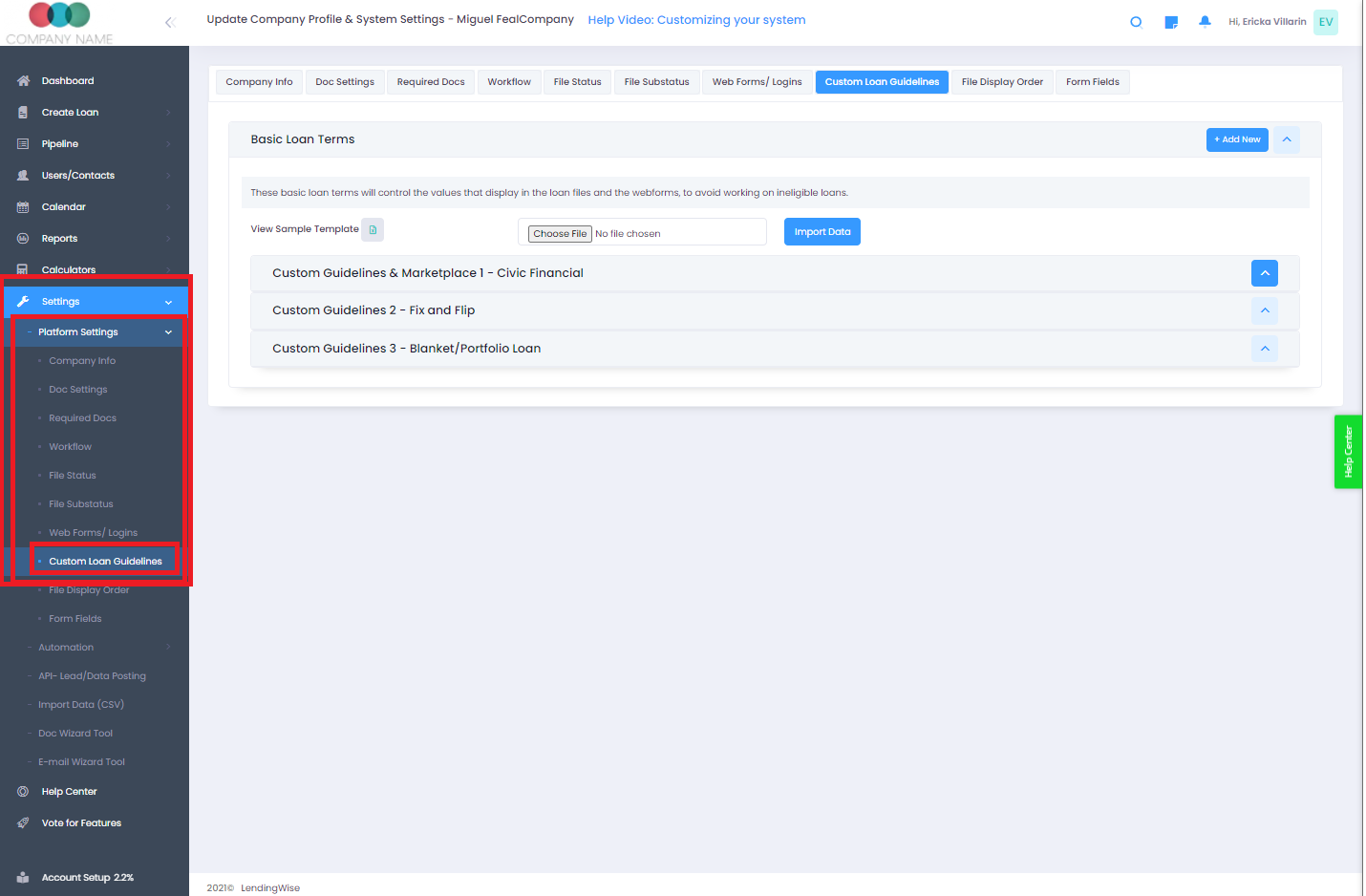

Company Settings > Custom Loan Guidelines tab

This feature lets you control loan-level & borrower level parameters specific to a loan program. For example, for loan program= fix & flip, you can set allowed transactions type to purchase & cash out refi, set the property types you support, loan terms, occupancy requirements, and eligible States. These changes will control the values in the drop-down form fields, hence acting as an eligibility filter for your webform and avoiding the entry of ineligible deals for any logged-in user.

Other parameters in loan guidelines allow you to set the min & max loan amounts, min/max points, min/max rate, max LTV on a purchase, cash-out refi, rate/term refi, ARV, which displays a red alert for users indicating the loan has exceeded the guidelines.

Additional Purpose: Marketplace Eligibility Engine

The custom loan guidelines are tied to an eligibility engine, which uses this info to match a loan to your loan programs & their respective guideline parameters. You can add your own private lender/investor/capital providers with their specific loan programs, usually done by marking a loan program as an "internal loan program". The marketplace feature can be private to only enabled users. When working on a loan, your back office team will be able to see all loan programs that match, as well as loan programs LendingWise suggests from other direct lending or capital providers. You will be able to submit loan scenarios directly to the lenders in the search results.