Personal Income and Expense Tab

This article details the 'Personal Income & Expense' tab in LendingWise, its role in storing personal income and expenses details, calculating the DTI ratio, and how to navigate to it.

In the LendingWise platform, the 'Personal Income & Expense' tab plays a crucial role in storing and managing essential financial details for both borrowers and co-borrowers. A key feature is the calculation of the Debt-to-Income (DTI) ratio.

Understanding the 'Personal Income & Expense' Tab

This tab offers a comprehensive space to keep track of the borrower's or co-borrower's personal income and expenses, streamlining the management of these financial details.

The dynamic feature of calculating the Debt-to-Income (DTI) ratio aids in assessing an individual's ability to manage payments and debts, a critical factor in the lending decisions.

Accessing the 'Personal Income & Expense' Tab

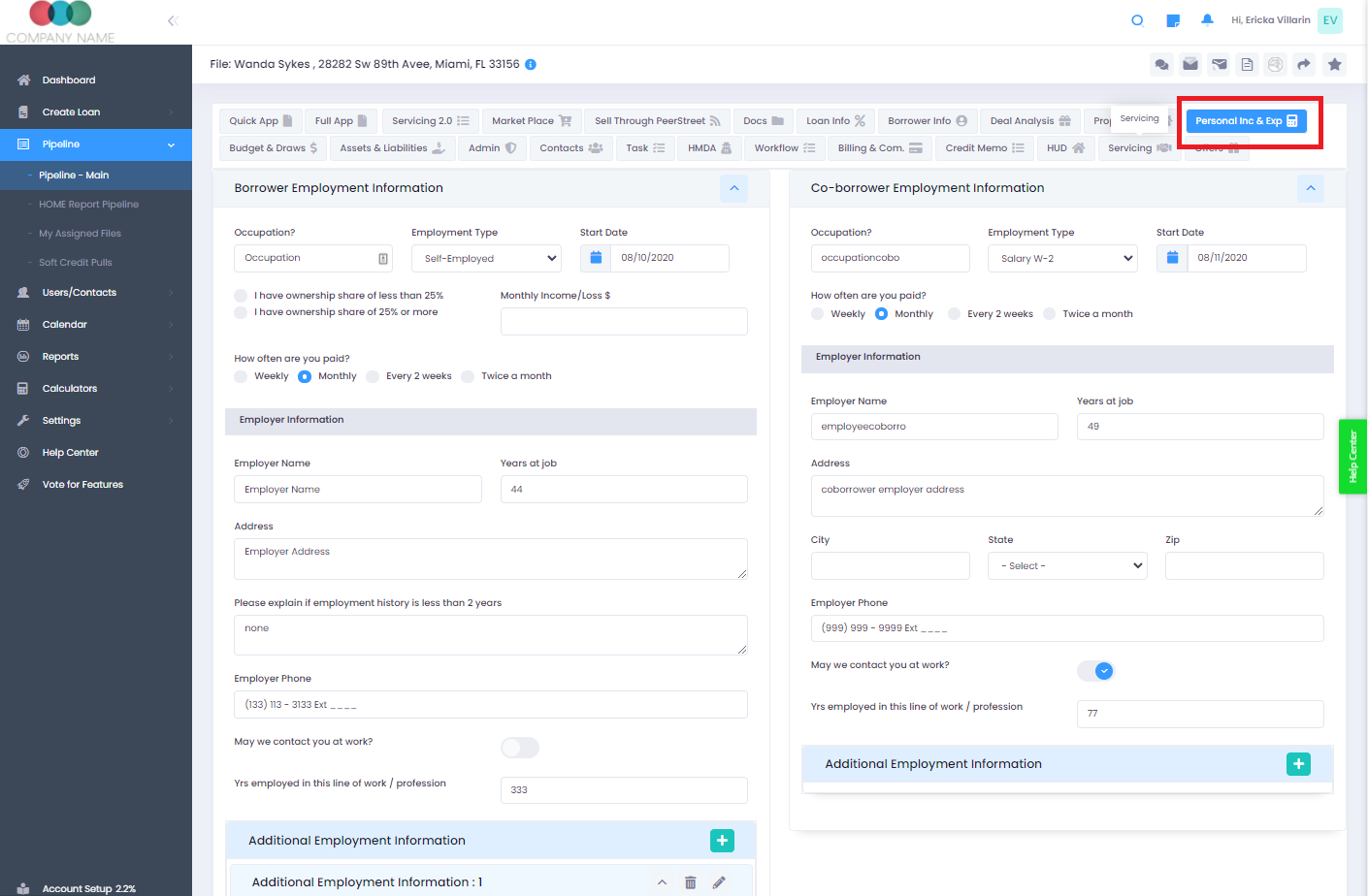

Follow the path from the 'Pipeline' directly to the borrower's profile. Here, you'll find the 'Personal Inc & Exp' tab housing all related information.

-

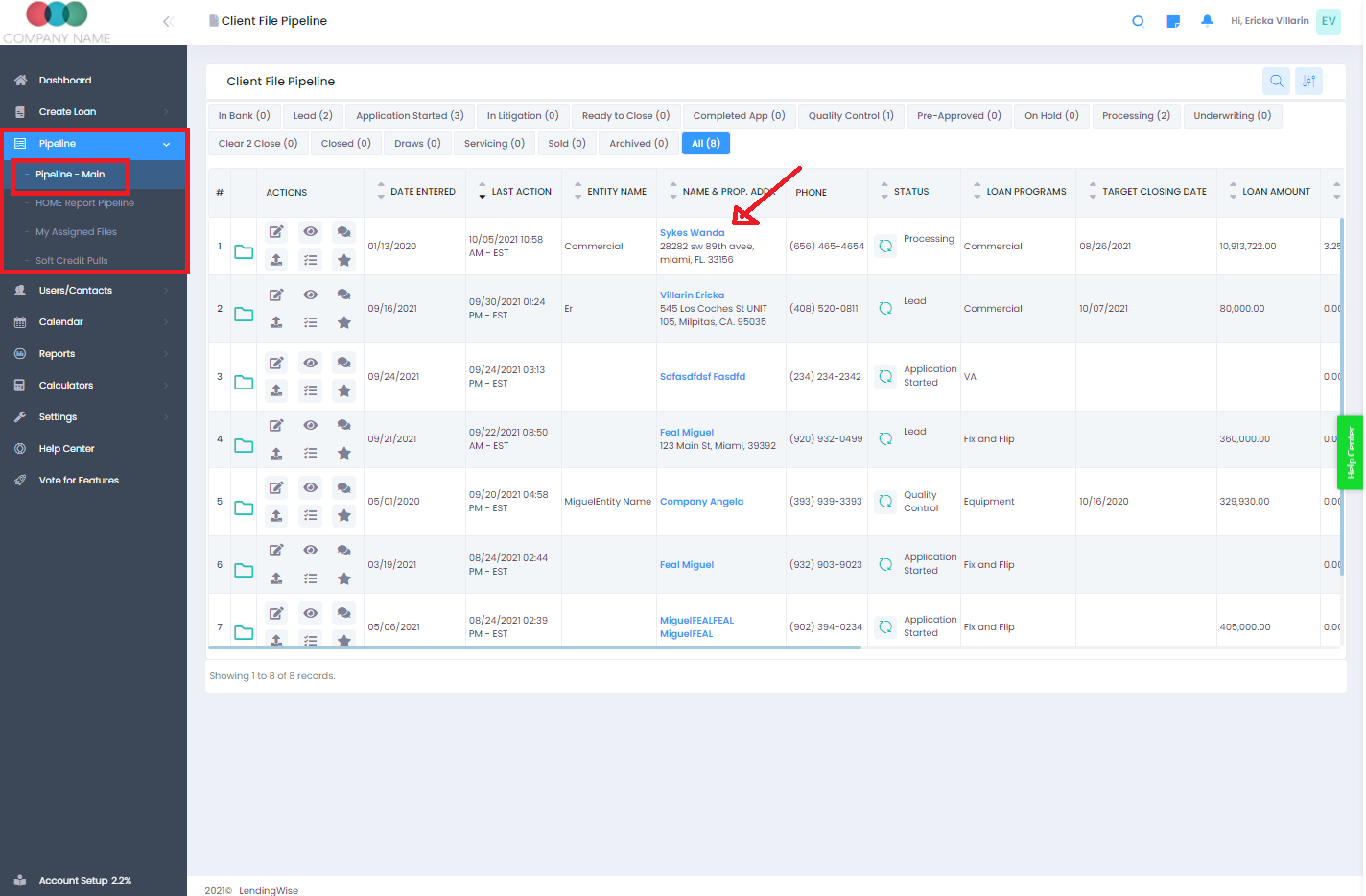

Navigate to the 'Pipeline': From the dashboard, start at the 'Pipeline'.

-

Select the Borrower's Profile: Choose the specific borrower whose financial details you want to view or edit.

-

Access 'Personal Inc & Exp' Tab: Here you'll find all the data related to the borrower's or co-borrower's personal income, expenses, and their calculated DTI.

The 'Personal Income & Expense' tab offers crucial insight into the financial health of your clients, ensuring informed lending decisions. For further assistance or queries, please feel free to contact the LendingWise support team at helpdesk@lendingwise.com.