Servicing 2.0 (Sunsetting Soon)

This article guides you through setting up and using LendingWise's Servicing 2.0, from initial setup in the "Loan Info" tab to using the different features in the “Servicing 2.0” tab.

The LendingWise enhanced Servicing 2.0 feature, currently supporting only Bridge and Fix and Flip loan programs. ARM loans are not applicable at this point.

Servicing 2.0 will be sunsetting soon and replaced with our new and improved Servicing feature. See: Servicing Module Roadmap & Status Update

Setting Up Servicing 2.0

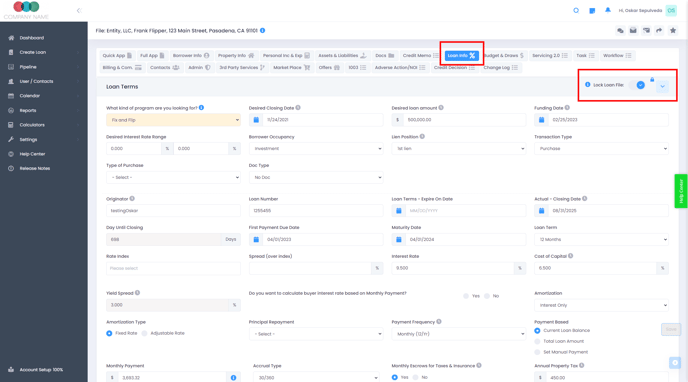

To ensure Servicing 2.0 functions correctly, initial setup in the "Loan Info" tab is vital. Here are some important aspects that need to be verified:

- Amortization.

- Loan Terms.

- Accrual Type.

- Monthly Payment.

- Payment Basis: Current Loan Balance or Total Loan Amount.

- Maturity Date.

- First Payment Due Date.

Then navigate to the 'Fees & Cost' section and validate the configurations under 'Extension Fees'. The data from this section will be ported to the Servicing 2.0 tab as well.

**Lock the Loan File**: Once ready for servicing, typically during loan closing or after sending the final loan commitment, lock the loan file in the "Loan Info" tab (as shown in the image above) to prevent further modifications.

Using Servicing 2.0

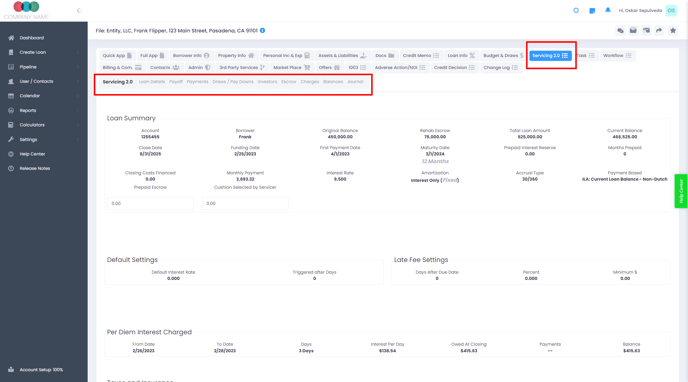

With the initial setup finalized, you're now ready to use the Servicing 2.0 tab. Here are some highlights of the Servicing 2.0 tab features:

- Loan Details: Review the 'Loan Summary' along with 'Default Settings' and 'Late fee settings'.

- Payoff: Enter the payoff date and generate a payoff statement.

- Payments: Record payments on this tab. The 'Preview Statement' button allows viewing the statement as of the last payment due, which can then be sent to your client.

- Draws/Paydowns: Record principal paydowns here. Details from the 'Budget and Draws' tab will automatically populate in this section.

- Investors: Record details of multiple investors along with their yield and interest. Payments applied to investors also get recorded in this section.

- Escrow: Create an escrow statement here.

- Charges: Record any additional charges to be applied to the loan.

- Balances: Keep track of balances.

- Journal: Update and maintain your journal in this tab. You can also export an XLS file.

Step-by-Step Walkthrough

Servicing 2.0 allows the convenience of managing loans efficiently within the LendingWise platform, making loan monitoring a simplified process for Bridge loans and Fix & Flip loans. For any further questions, please reach out to the LendingWise support team at helpdesk@lendingwise.com.