Soft Credit Pulls

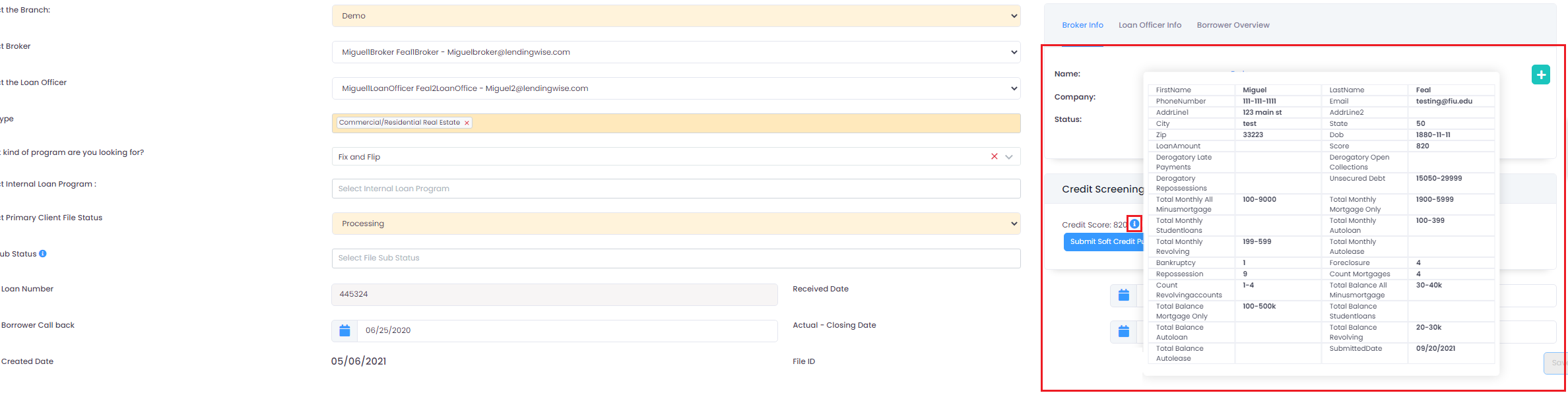

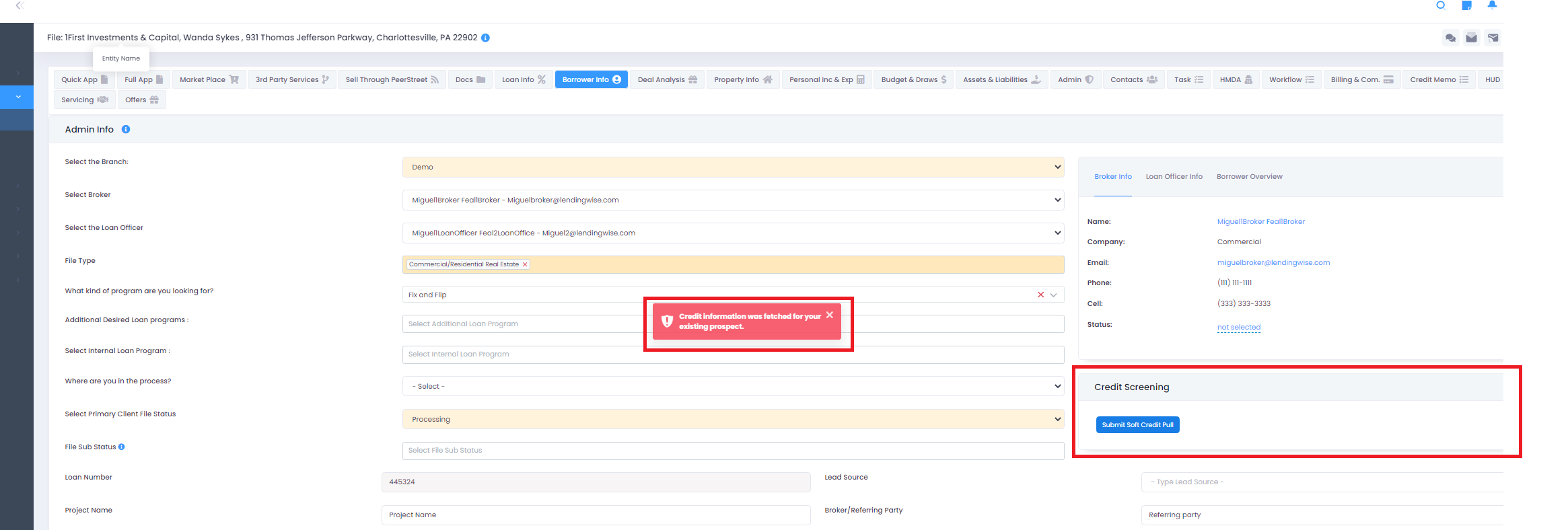

A soft credit pull can be run directly from the soft credit pipeline or inside a loan file under the Quick or full app tab.

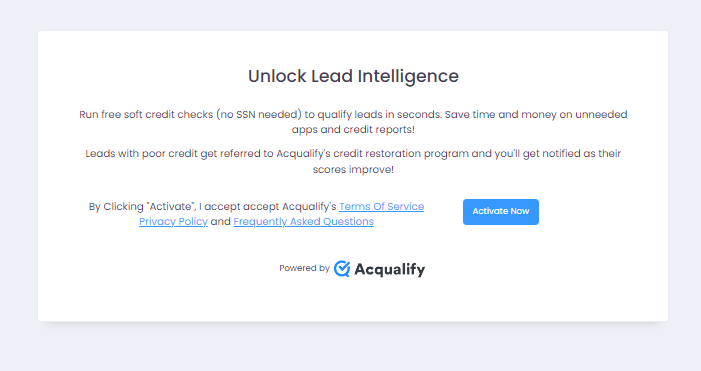

Make sure that this feature is activated. To activate the soft credit pull you need to:

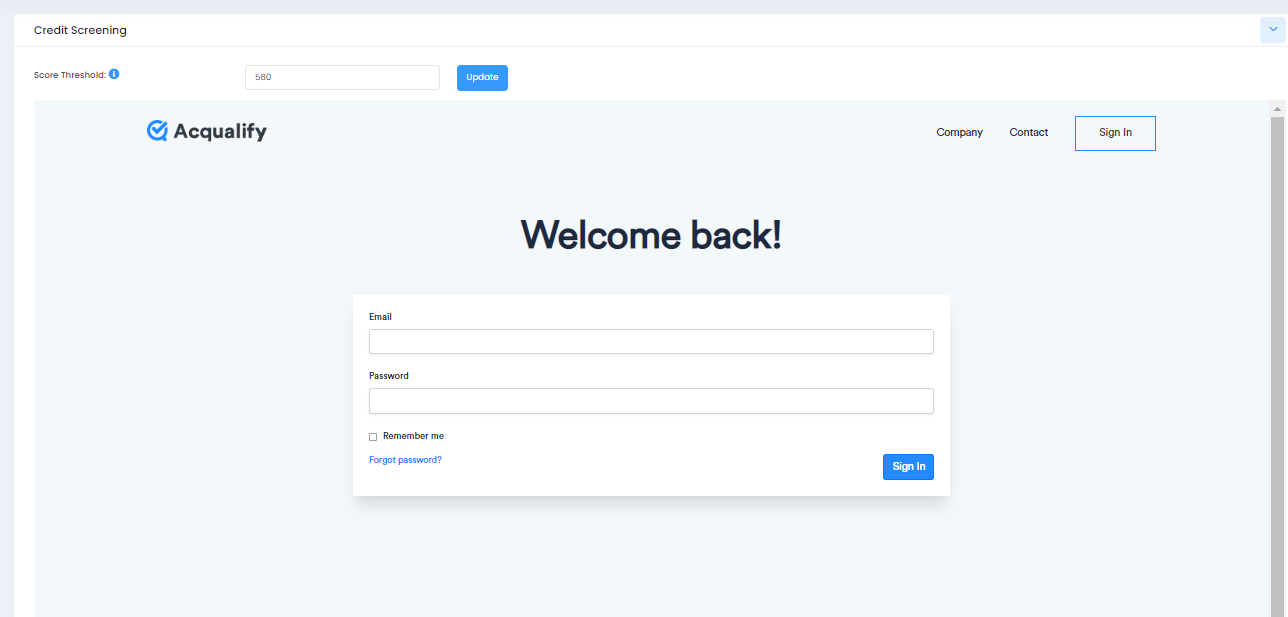

1. Log in to your LendingWise account.

2. Select Pipeline and choose Soft Credit Pull, then click "Activate Now". Make sure to first accept terms to activate soft credit pulls.

3. You will be asked to log in to your Acqualify account. Kindly create an account if you don't have one yet.

Once the feature is enabled for your account, look under the pipeline menu option, and you will see soft credit pulls. A soft credit pull can be run directly from the soft credit pipeline or inside a loan file under the Quick or full app tab. Each user (back office, branch, loan officer, or broker) will need permission enabled if you want them to use the soft credit pull feature.

FYI: You can only run the soft credit every 30 days. So if you try to resubmit the report, you will be prompted with an error.

When running a soft credit pull.

- If all information is correct and successful. You should see the following:

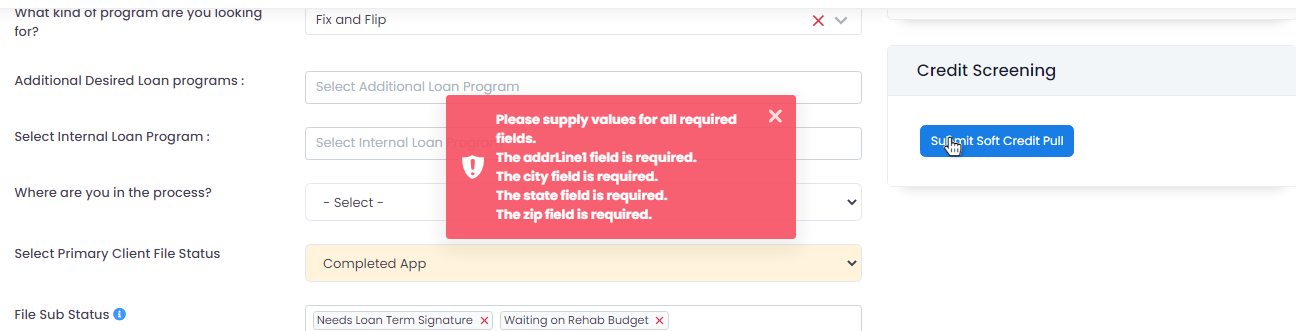

The required fields to run soft credit are: first & last name, address, phone, E-mail & Date of birth.

- If information is not provided correctly or system cannot find information, you will receive this error message.

FAQs

It will only display one score as shown in the images above in this article.

Click on this link�to reset your password or please submit a ticket via the help center. Miguel will help you in obtaining your userID.

If you are located outside of the U.S.A. and would like access, please email helpdesk@lendingwise.com